I am at the point now when I can no longer contribute to my RRSPs. For the first time since I was about 12 I have NO EARNED INCOME!! What a lazy a– I’ve become eh?

The last few days I’ve been going over my RRSP options. There are many different lines of thought and most have to do with whether to let my RRSPs sit and earn interest until I’m 71 at which time the RRSPs would convert to an RRIF and there would be a minimum amount withdrawn and added to my annual income….OR….withdraw so much a year NOW and add to my Tax Free Savings Account or Tax Free GICs.

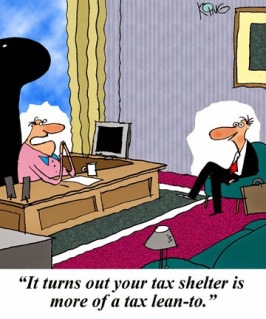

The crux of the matter is which option saves me the most in tax dollars? I’m leaning towards starting RRSP withdrawals NOW while my income is at its lowest. Right now I’m just living on my school pension with additional bump ups to my income coming when I start to receive Canada Pension and then Old Age Supplement. If I wait til I’m 71 to start taking money out of a RRIF then I will be pushed up into a higher tax bracket. For the rest of my LIFE!!

On the other hand if I can get my money out of my RRSPs over the next few years and tucked safely away into a TFSA my tax bracket will remain lower, thus paying less in taxes. We Canadians are currently allowed to put $5,500 per year into a TFSA where it is tax-sheltered forever. I’d like to start removing $5,000 per year from my RRSPs and place it into my TFSA. Of course there is withholding tax when I remove $$ from my RSP which increases based on the amount withdrawn. The tax rate for $5,000 is 10%. So I would receive $4,500. However, at tax time I might see some of that withholding tax come back to me.

I feel that this is the right way to go. The consensus is that it’s best to withdraw RRSPs when your income is at its lowest. Which is now.

Decisions, decisions…

Filed under: income tax, RRIFs, RRSPS, savings, tax bracket, TFSA | 8 Comments »